On-Chain Analyst Forecasts Bitcoin’s Imminent Need for Action – Expert Offers Insights

A well-known on-chain analyst predicts that Bitcoin (BTC) is on the verge of a significant price movement after months of consolidation.

Checkmate, an anonymous analyst, informs his 91,900 followers on the social media platform X that a crucial on-chain metric for Bitcoin indicates that it is almost time for BTC to break free from its consolidation phase.

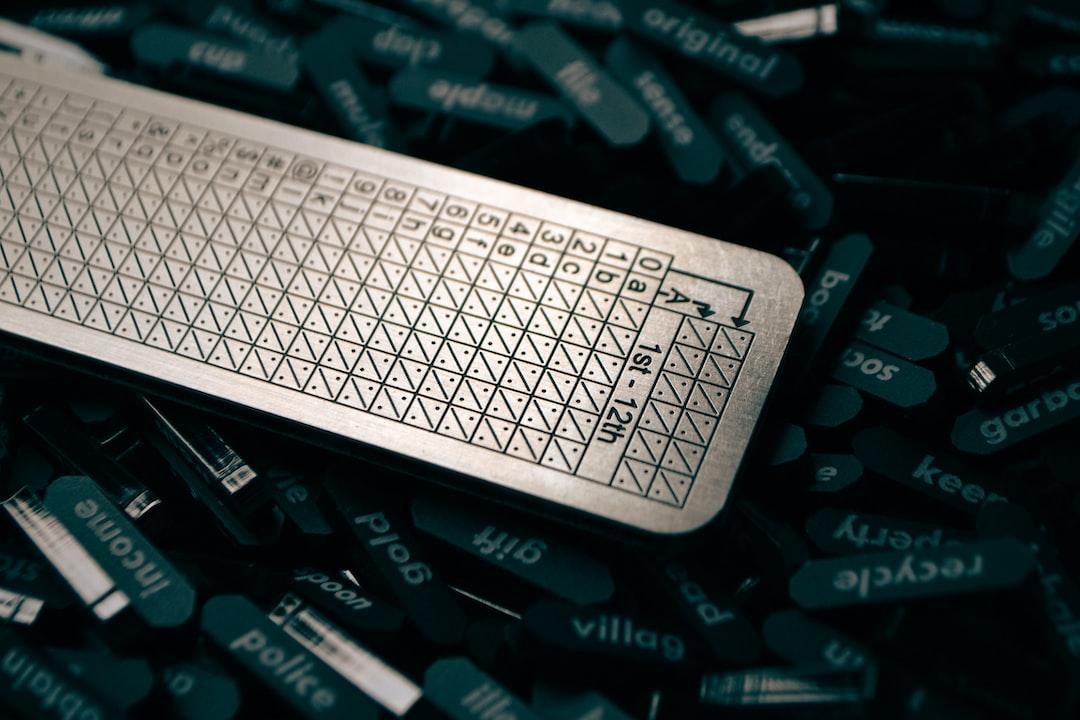

The analyst explains that BTC’s sell-side risk ratio for short-term holders is rapidly decreasing, implying that sellers are running out of ammunition. Checkmate specifically focuses on the short-term holder cohort, which consists of entities that have held BTC for less than 155 days, as they are the ones driving short-term price action.

“Range contraction (consolidation) leads to Range Expansion (trending). Bitcoin is coiled like a spring, and it usually doesn’t stay still like this for long. The sell-side risk ratio for short-term holders is dropping rapidly, indicating it’s time to make a move.”

Source: Checkmate/X

Checkmate identifies the US bond market as a potential catalyst for the next major Bitcoin movement. According to the analyst, if the 10-year yield rate (US10Y) approaches 5%, conditions may become unfavorable for Bitcoin and the crypto market.

Checkmate emphasizes that “higher yields mean tighter conditions, less valuable collateral, and reduced overall risk tolerance.”

“On the chart below, I’ve highlighted in red the significant sell-off in bonds that occurred between August and October 2023. During this period, US-10y yields approached 5.0%, equities dropped by 10%, and Bitcoin experienced a 12% sell-off in a single day. However, BTC then consolidated for two months and surged by 30%.”

“When 10-year yields trade close to 5%, the Fed and Treasury have previously expressed concerns about market dysfunction and intervened to stabilize prices. This is a reasonable explanation for why Bitcoin initially sold off but later rallied higher.”

“The bond market has the power to dictate the fate of risk assets and financial stability. If yields continue to rise, it could enter a territory where things could get volatile quickly.”

Source: Checkmate/CheckonChain

Bond prices and yields typically move in opposite directions. When yields rise, the prices of older bonds drop as they have to compete with newer bonds that offer higher interest rates.

At the time of writing, the US10Y stands at 4.394%, while BTC is trading at $68,643.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook, and Telegram

Surf The Daily Hodl Mix

Disclaimer: The opinions expressed in The Daily Hodl are not investment advice. Investors should conduct their own research before engaging in high-risk investments in Bitcoin, cryptocurrency, or digital assets. Please be aware that your transfers and trades are at your own risk, and any losses incurred are your responsibility. The Daily Hodl does not endorse the buying or selling of any cryptocurrencies or digital assets, nor is it an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: DALLE3